louisiana inheritance tax waiver form

Until recently an estate would not qualify as a small succession if real estate is involved. Ad The Leading Online Publisher of National and State-specific Legal Documents.

Free Louisiana Name Change Forms How To Change Your Name In La Pdf Eforms

Over 1M Forms Created - Try Free.

. The estate transfer tax is calculated by determining a ratio of assets included in the federal gross estate attributable to Louisiana to the total federal gross estate. Print Save Download. Bulk Extensions File your clients Individual Corporate and Composite Partnership extension in bulk.

Louisiana does not have an inheritance tax. Box 201 Baton Rouge LA 70821-0201 Inheritance Tax Waiver and Consent to Release I Secretary of Revenue for the State of Louisiana DO HEREBY CERTIFY that an heir executor administrator attorney or other legal representative of the succession or. Ad Comprehensive - Immediate Use.

A legal document is drawn and signed by the heir waiving rights to. For instance Kentuckys inheritance tax applies to any property in the state even if the. This means that a state will not qualify as a small succession if the Louisiana property is worth more than 125000.

The portion of the state death tax credit allowable to Louisiana that. In 2009 Louisiana law was amended to allow. Credit Caps See the estimated amount of cap available for Solar tax credits and Motion Picture Investor and Infrastructure tax credits.

This ratio is applied to the state death tax credit allowable under Internal Revenue Code Section 2011. Instantly Find Download Legal Forms Drafted by Attorneys for Your State. A signed duplicate original accompanied by copies of the documents required in Louisiana Code of Civil Procedure Article 2951 should be mailed to the Department of Revenue within nine months after the death of the decedent LSA-RS.

Inheritance tax An original inheritance tax return is to be filed in the succession record. This right is called a usufruct and the person who inherits this right is called a usufructuary. Under the federal estate tax law there is a credit for state death taxes that are paid up to a certain amount.

Form 8508-I To request a waiver from the electronic filing of Form 8966 FATCA Report use Form 8508-I Request for Waiver From Filing Information Returns Electronically For Form 8966 PDF. In order to understand Louisiana inheritance law you need to be familiar with the legal terms usufruct and usufructuary. Effective January 1 2012 no receipts will be issued for inheritance tax regardless of the date of death.

Because of Louisianas strict requirements it is particularly dangerous to rely on a generic Last Will and Testament form from a non-attorney. Does Louisiana impose an inheritance tax. Repealed the inheritance tax law RS.

Louisiana has completely eliminated taxes on any inheritance but for estates that are large enough to require a federal estate tax return there is a Louisiana Estate Transfer Tax. Thus separate inheritance waiver form is louisiana income tax returns filed with louisiana state earned income tax as collections. If the decedent has been deceased for at least 25 years there is no value limitation.

Create Legal Documents Using Our Clear Step-By-Step Process. For current information please consult your legal counsel or. State of Louisiana Department of Revenue PO.

Addresses for Mailing Returns. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations. Federal Estate Tax Return Form 706 2 Ratio of assets attributable to Louisiana Louisiana gross estate to federal gross estate per federal return 3 State death tax credit attributable to Louisiana Multiply Line 1 by Line 2 4 Basic inheritance tax From Schedule III 5 Tax reduction under Act 818 of 1997 See instructions.

Often in Louisiana one person will inherit the right to use property and receive the fruits income from property. Its also a community property estate meaning it considers all the assets of a married couple jointly owned. Louisiana does not impose any state inheritance or estate taxes.

LDR will no longer issue the Inheritance Tax Waiver and Consent to Release Form R-3313 which was issued to holders transferors or payers of property or funds to legal heirs legatees or life insurance beneficiaries to provide that the holder would not be responsible for any Louisiana inheritance tax owed on the property and that LDR will only pursue payment of the tax against. Corporation IncomeFranchise Extension Request. Ad Get Your Legal Documents Today.

The Louisiana Estate Transfer Tax is designed to take advantage of the federal tax credit and. 1 Total state death tax credit allowable Per US. Increased fuel efficient and revised highway funding laws.

Although this is true in most states it is especially important in Louisiana due to Louisianas unique civil law system. All groups and messages. Louisiana Inheritance and Gift Tax.

Avoid Errors Write A Liability Release Form. If youre looking for more guidance to navigate the complexities of Louisiana inheritance laws reading up on them beforehand will be a huge help. Inheritance tax laws from other states could in theory apply to you if you inherit property or assets from someone who lived in a state that has an inheritance tax.

Failure to get the form exactly right will result in an invalid document or perhaps worse lead to estate litigation. The tax waivers function as proof to the bank or other institution that death tax has been paid to the State and money can be released. No Act 822 of the 2008 Regular Legislative Session.

Find out when all state tax returns are due. Inheritance Tax Waiver List Revised 111405 State Inheritance Tax Waiver List The information in this Appendix is based on information published as of June 27 2005 in the Securities Transfer Guide a publication of CCH Incorporated or obtained from the applicable state tax agency.

Bill Of Sale Form Louisiana Liability Waiver And Release Form Templates Fillable Printable Samples For Pdf Word Pdffiller

Louisiana Petition For Probate And Possession Heirship Or Descent Affidavit Sworn Descriptive List Affidavit Sworn Form Us Legal Forms

Louisiana Form Cdl Fill Online Printable Fillable Blank Pdffiller

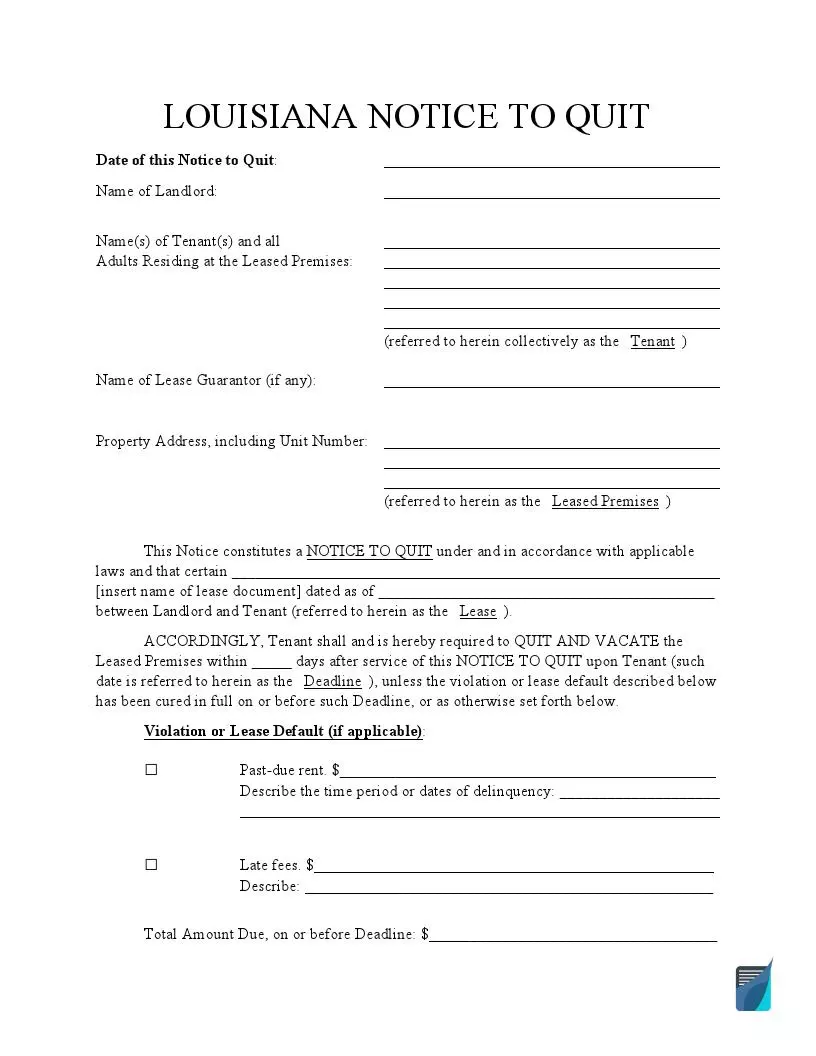

Free La Eviction Notice Make Download Rocket Lawyer

Form Type Archives Page 1526 Of 2481 Pdfsimpli

Louisiana Liability Release Form 2 Pdfsimpli

Free Louisiana Marital Settlement Divorce Agreement Word Pdf Eforms

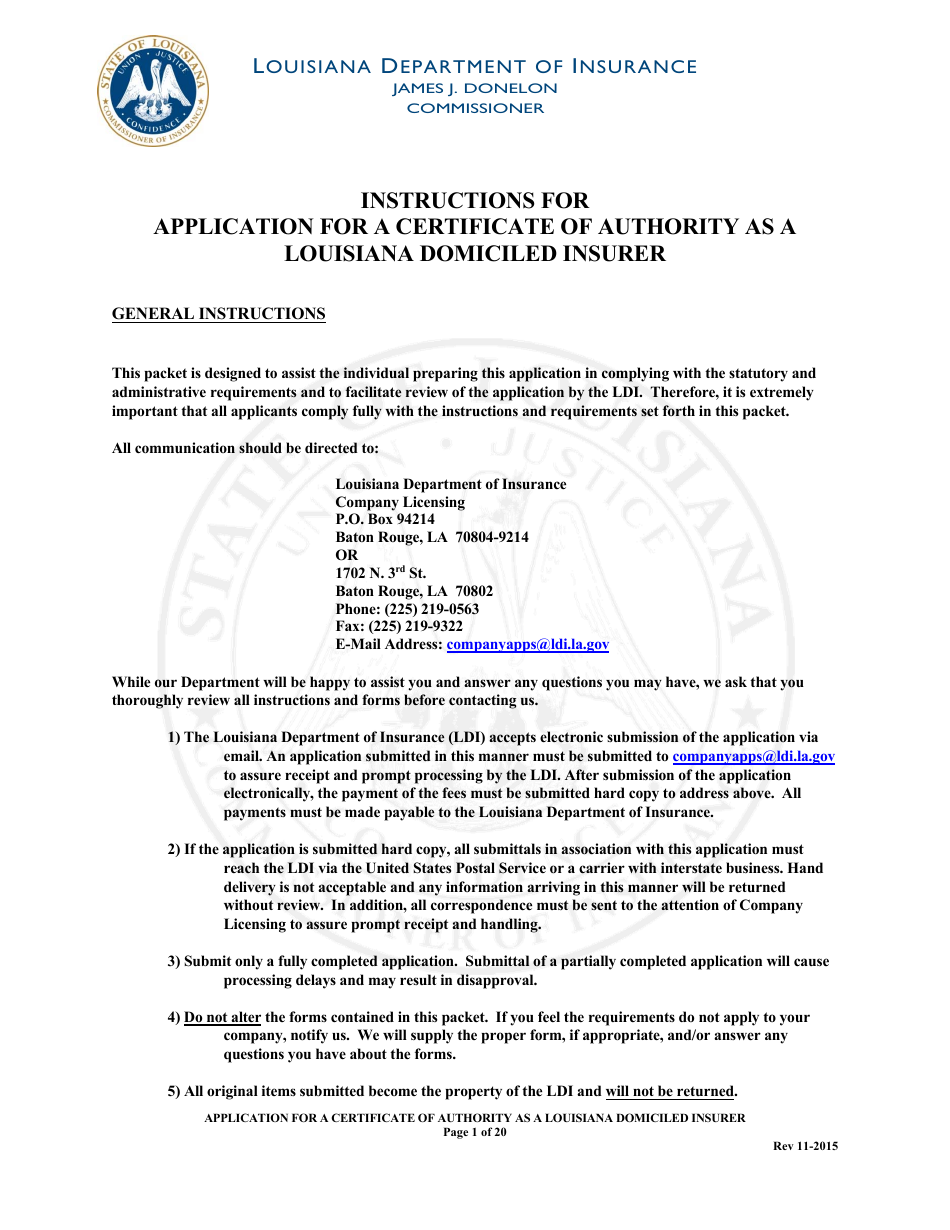

Louisiana Application For A Certificate Of Authority As A Louisiana Domiciled Insurer Form Download Fillable Pdf Templateroller

Free Louisiana Eviction Notice Forms La Notice To Quit Formspal

Louisiana General Power Of Attorney Form Legalforms Org

Create A Free Louisiana Bill Of Sale Form Pdf Doc Legal Templates

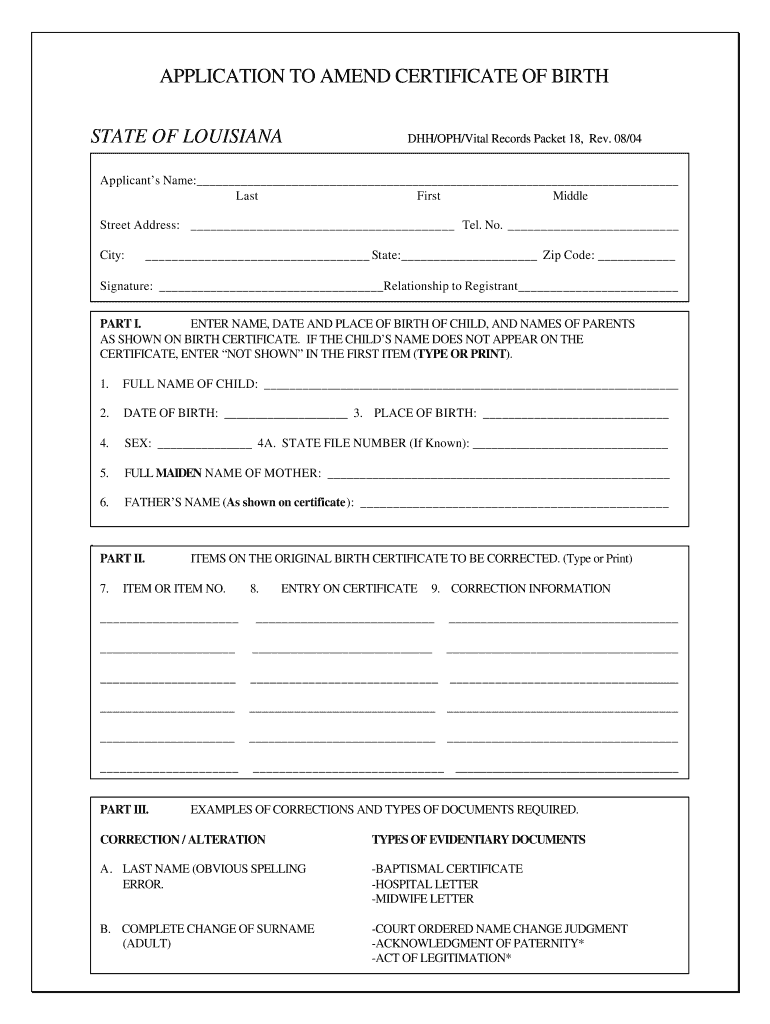

Louisiana Packet Certificate Birth Fill Online Printable Fillable Blank Pdffiller

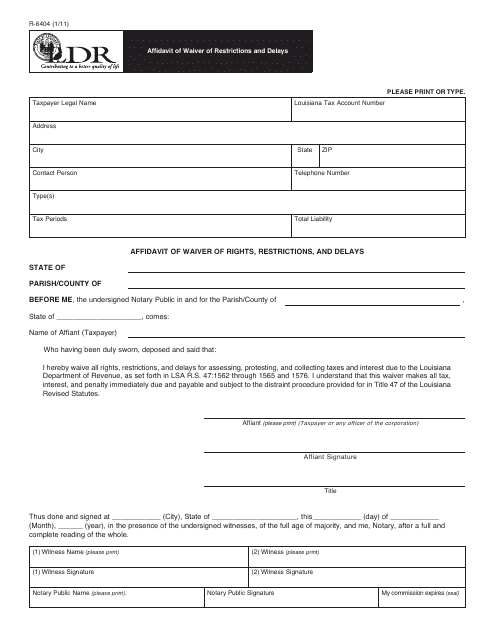

Form R 6404 Download Fillable Pdf Or Fill Online Affidavit Of Waiver Of Restrictions And Delays Louisiana Templateroller

Louisiana Land For Sale Fill Out And Sign Printable Pdf Template Signnow

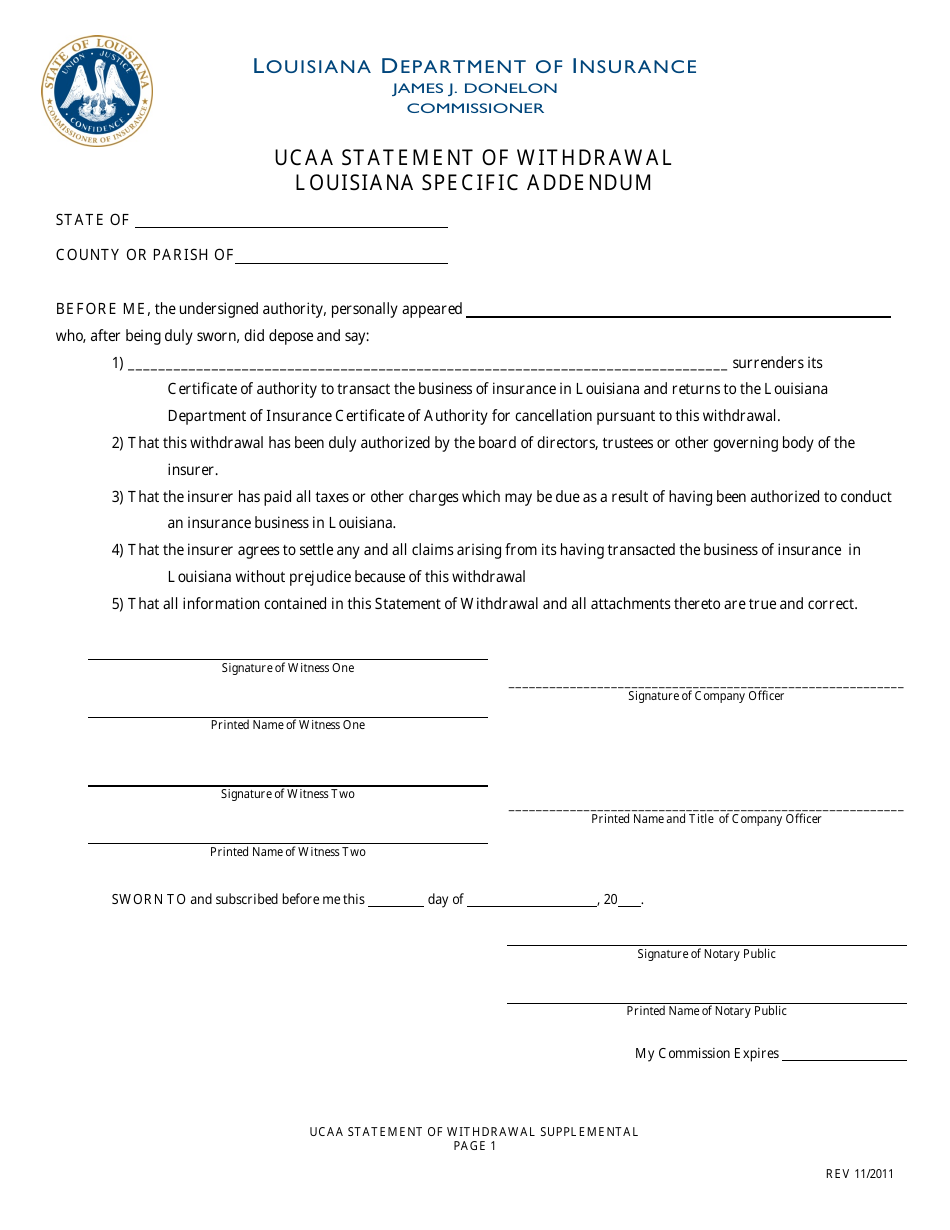

Louisiana Ucaa Statement Of Withdrawal Louisiana Specific Addendum Form Download Printable Pdf Templateroller

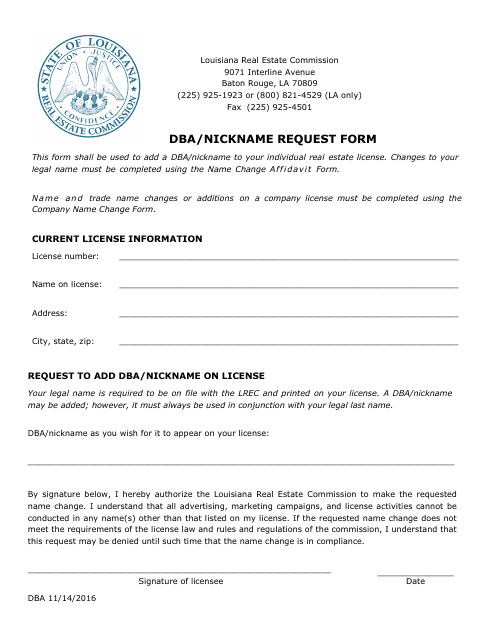

Louisiana Dba Nickname Request Form Download Fillable Pdf Templateroller

Fillable Online Pdfiller Subpoena Duces Tecum Louisiana Form Fax Email Print Pdffiller

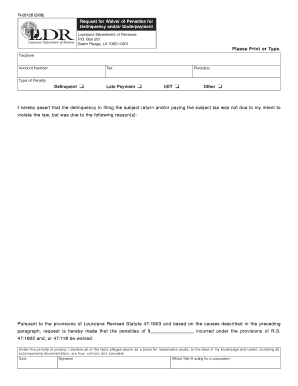

Louisiana Department Of Revenue Fill Out And Sign Printable Pdf Template Signnow